Earlier this week, Equity Bank released its Q3 numbers for the period ending 30th September 2015 with the bank posting Kshs. 12.85 billion in pre-tax profit. One of the key factors that caught my attention was the fast growth of its Equitel platform. The bank announced that 50.4% of all cash transactions taking place at the Bank were performed through Equitel surpassing both branches and ATMs. Equitel allows users to access loans 24 hours a day having issued Kshs. 4 Billion in loans so far. The average loans issues through the platforms are Kshs. 5,000 with peak hours between 1 am to 5 am, underscoring the importance of the platform to small scale traders. Equity has not stated if the borrowers on its mobile platform will face increased interest rates.

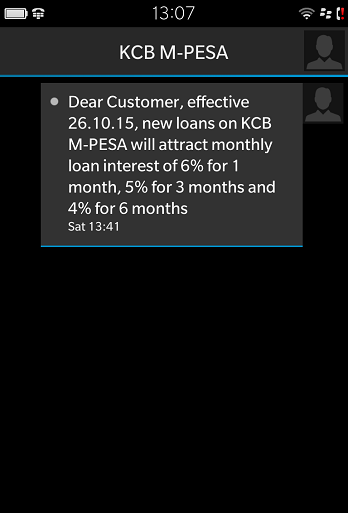

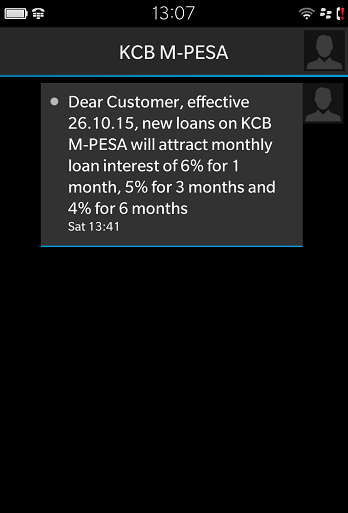

Still this week, KCB Bank sent a text message to its KCB M-Pesa account holders informing them of their intention to raise interest rates for its mobile loans to users to 6% for 1 month loans, 5% for 3 months and 4% for 6 month loans. In March, KCB and Telco Safaricom partnered to launch the KCB M-pesa account, a facility aimed at increasing financial inclusion through savings as well as issuing loans through Safaricom’s mobile money service M-pesa. As of its last report in July, KCB said it was offering to the tune of Kshs. 130 Million weekly in loans to users. Another player in this segment is Commercial Bank of Africa which, runs M-Shwari in collaboration with Safaricom. M-shwari users are yet to be hit with an increase in interest rates but its just a matter of time.

The increase in interest rates by Commercial Bank stems from a decision by the Kenyan government to borrow in the domestic markets to meet budgetary deficits. The government is borrowing up to Kshs. 221 Billion in the form of treasury bills and bonds at a rate of 22%. The decision by the government has seen Commercial Banks inadvertently raise interest rates to between 24-27%.

Some backstory, the core businesses of banks is lending money to individuals and businesses where they charge interest rates on the loan amount based on the period of time you will need the money. Banks also take deposits in form of savings and pay interest rates on the principal amount. Now, there is always the risk of a borrower defaulting on the loan issued to them by the bank, which directing impacts a bank’s profit and loss as well as tax payments. However, governments which borrow through bills and bonds have limited chances of defaulting on loans issued them, making them an attractive investment for banks. With that in mind, Kenyan banks are finding it more attractive to lend to government at the 22% interest rates offered, which risk free.

In addition, banks cannot continue to lend to users at rates lower than what is offered by the government as this will lead to interest rate arbitrage. Arbitrage is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. If the banks were to offer loans at say 16%, lenders would borrow at 16% from the banks and invest this money in the treasury bills for the 22% the government is issuing and pay back to them, which means Banks wont make money!

Back to the matter at hand, the raising interest rates are definitely going to affect mobile loans. First of, the issuers of these loans are commercial banks and like I explained with interest rate arbitrage, banks are obviously out to make money and its unlikely they will retain the interest rates on mobile loans on the low. This will inadvertently lock out borrowers especially small businesses seeking to meet their day-to-day needs. In recent times, many of these mobile loan lenders have been referring loan defaulters to the credit reference bureau. I think there will be increased risks of default on these loans especially by the heavy borrowers who will feel the pinch of the amounts involved in repayments. The cases of default will not be as widespread, but the lady downtown wont stop borrowing to meet her business needs owing to increase interest rates. The flip side is small businesses wont see enough profit. An equally likely occurrence is reduce demand for mobile loans on all these platforms. If you are used to borrowing Kshs. 1,000-5,000 and are used to small repayments amounts of say Kshs. 1,075 and owing to increased interest rates you are forced to pay Kshs. 1,100, you will likely be conscious of the new amounts being paid and your appetite for borrowing is reduced. The situation with high interest rates is likely to persist till June 2016, owing to government borrowing so, tighten your belts people! spend wisely.