A recent trade deal discussion between Kenya and the US has revealed that the super power wants Kenya adjust some of its local regulations.

The development was highlighted by the East African, following the US’s pressure that Kenya should support Israel’s commercial and political interests if the state wants to see the free trade deal implemented.

One of the key points from the deal is that Kenya must not tax digital products. This follows the draft Value Added tax (Digital Marketplace Supply) Regulations, 2020 that seeks to tax services that ae supplied in Kenya through the digital space.

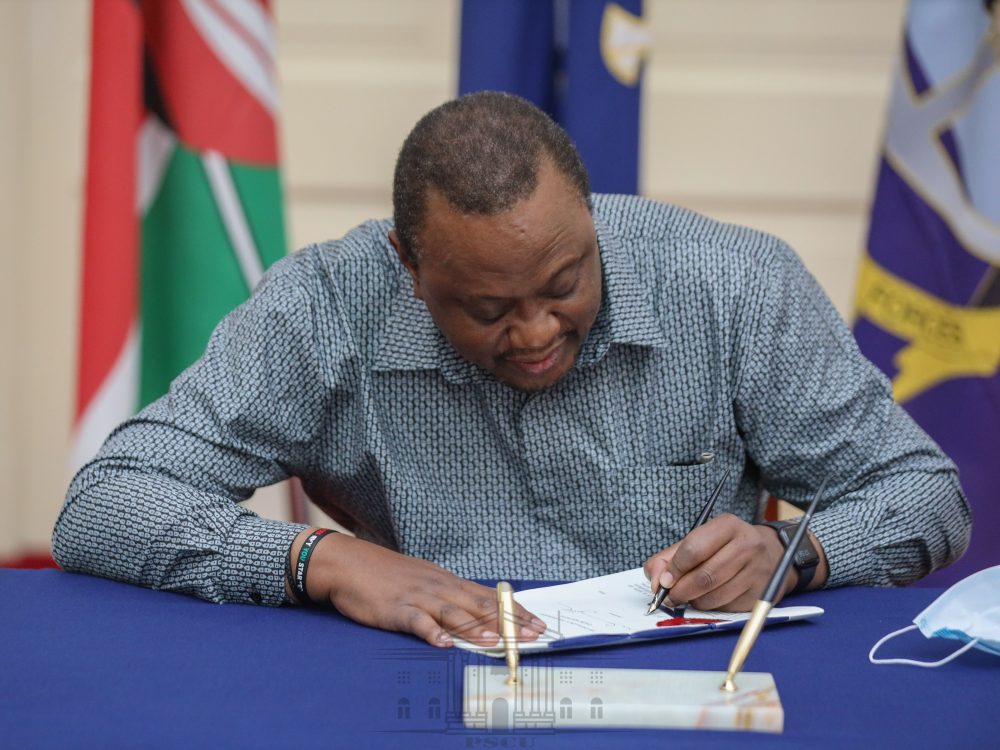

According to the proposal, the following services will be taxed should the draft receive the President’s signature.

- Downloadable digital content, including mobile apps, e-books, and films.

- Subscription-based media, including journals, magazines news, streaming services (Netflix, Showmax, et al.), as well as podcasts, online gaming, and music.

- Software programs including drivers, website filters, and firewalls.

- Electronic data management including web hosting, online data warehousing, file sharing, and cloud storage services,

- Supply of music, films, and games.

- Supply of search-engine and automated helpdesk services including supply of customized search-engine services.

- Tickets purchased for live events, theatres, restaurants et al. purchased through the internet.

- Supply of distance teaching via pre-recorded medium or e-learning services including online courses and training.

- Supply of digital content for listening, viewing, or playing or any audio, visual or digital media.

- Supply of services on online marketplaces that links the supplier to the recipient, including transport hailing platforms.

- Any other digital marketplace supply as may be determined by the Commissioner.

The US also wants Kenya not to compel US firms operating in Kenya to store data locally.

This follows the Data Protection Bill, 2019 that was signed into law in 2019. The bill has a clause that highlights the transfer of personal data outside Kenya.

According to the bill, data controllers and processors are allowed to transfer personal data to another state, but only when the data processor or data controller has assured the Data Commissioner that security safeguards have been put in place.

Furthermore, the ICT CS may prescribe, in line with the protection of revenue and other interests, select elements of processing can only be performed via a data centre based in Kenya.

This is the restriction that the US wants its firms exempted from.

We are not sure if these developments will see treasury drop the suggestions it made in the draft Value Added tax (Digital Marketplace Supply) Regulations, 2020.