Due to a tanking economy and high taxation, Kenyans often need loans. The many loan providers operating in Kenya need a management system and this is where Superlender Loan Management System comes in.

So, what is Superlender Loan Management System? Let’s be very clear, this is not a company that offers loan facilities. However, loan service providers need a system to manage all their services.

The system helps manage services for all types of lenders. This includes digital lenders who lend via Mobile Apps, Web Apps, or USSD.

The loan management system also supports microfinance lenders, asset financing companies, and group lending financial institutions.

Superlender Team with Years of Experience

Superlender is developed and managed by a team of 6 dedicated individuals. They are led by Jonah Ngarama.

Mr. Ngarama has vast experience working as part of microfinance institutions and with digital lending companies. For the last 12 years he has been developing financial applications for various instituons in Kenya.

A family man, he enjoys downtime away from coding by watching comedies to have a laugh.

Uniquely, he has set himself some personal challenges away from developing financial applications. With the blessings of his wife, he aims to overcome his fears and take part in deep-sea diving.

Currently, he is focused on leading his team working on Superlender.

He sees Superlender as a loan management system that offers a wholesome solution to all types of companies offering loans.

About Superlender

Superlender is a web-based platform developed on a mix of the latest software technologies. It is cloud hosted making it quick and easy to deploy and scale.

In addition, the use of the latest technologies makes it a very robust and secure system.

The technology mix makes it secure from the threats that a financial system is prone to. Superlender has been fortified to thwart all forms of cybersecurity threats. This ensures user data and privacy is always protected.

Additionally, the robustness of the system makes it available around the clock. Till today, the system boasts of zero data breaches or unauthorized access.

The Superlender team has made security updates a consistent part of their standard operating procedure.

Furthermore, the system has user Privileges. The user privileges set up the loan approval process. This means, one can set the number of users who need to approve a loan before disbursement.

Customizable Features and Modules

Superlender is a broad-core application that has different features. The large core app is customizable to suit the specific needs of any loan lending company.

The app allows a company to capture customer data. Data is captured in different forms to allow a loan lender to capture data that suits their loan product.

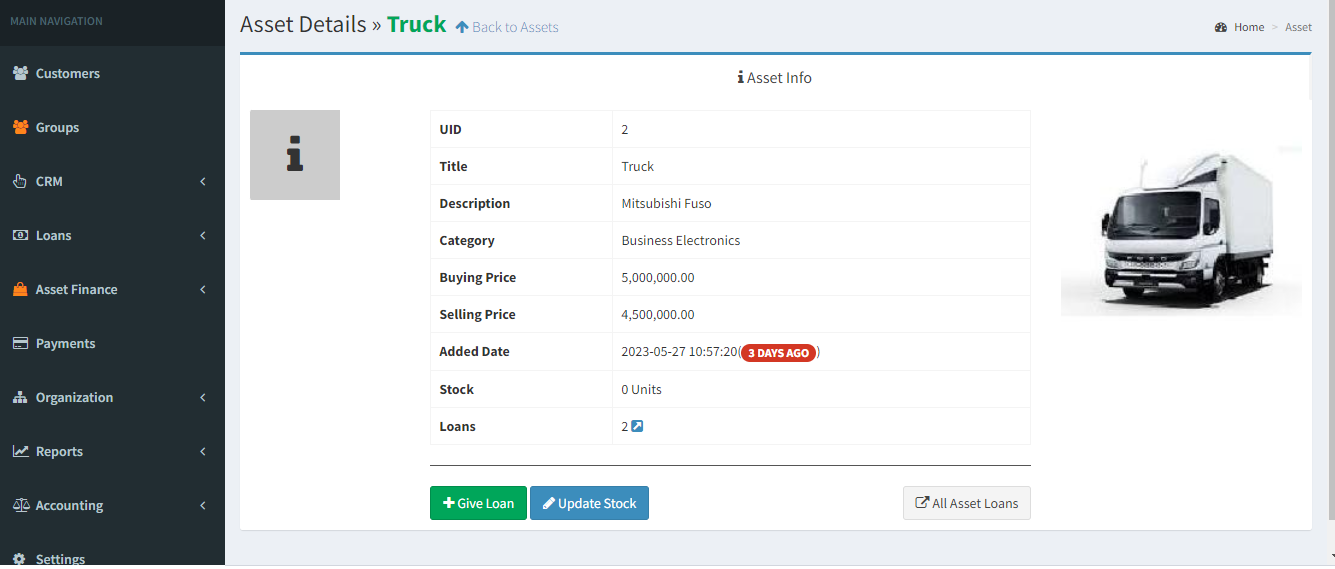

One can quickly capture customer data, business information, and more. For instance, a lender needing to document collateral when offering loans can upload images of the assets used as collateral.

Additionally, the data captured is not fixed. Users can add new form fields to enable them to capture data that best represents their loan products.

Thus, all necessary client documentation can be saved in the system.

Custom Loan Products

Loan companies in Kenya have different loan products that they offer to their target market. The customizable nature of Superlender makes it a great system for this.

A Superlender user can easily create a new loan product and set the criteria that define the product. The friendly interface and the ease of use makes creating these new products a very quick process.

For example, if you creating a new product offering loans to Mama Mboga’s, you can set up the loan product on Superlender.

You can set the time period of the loan, the users who access the loan period, the interest rate, and much more.

Superlender API

The app has ready APIs that allow it to interface with shortcodes, USSD, Mobile Apps, and other providers like M-Pesa.

Interfacing with client-facing applications makes it easy for loan service providers to receive loan requests and disburse them smoothly. All this is done through the system.

CRM and Broadcast SMS

The system has an SMS feature. This is critical as it allows customers to send loan reminders, promotions of new loan products, and other alerts.

Additionally, SMS broadcasts can be automated so that an SMS is sent based on a given criteria. For example, a person whose loan is due can receive periodic reminders based on set criteria.

The customer relationship manager (CRM) enables users to capture conversations they have with clients. This can include repayment terms and new client leads.

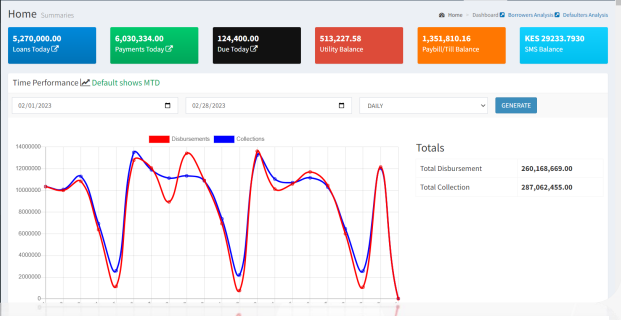

The system also has a robust and customizable reporting feature. Reports can be simple with few fields or have a wide range of data. Customers create reports based on their business needs.

All these are important in business management and decision-making for loan lenders.

Superlender Pricing and Deployment

The team at Superlender system is agile and always ready to deploy its solution. Firstly, they offer quite affordable services. Their smallest package starts at KSH 20,000 per month. This price is for customers who would like to use the system as a service.

The pricing depends on user needs. Hence, there is a price increase as the user needs also increase. Once a customer buys a subscription, the Superlender team will have them up and running in 48hrs.

Nevertheless, customers can also purchase the system and host it on their own cloud servers. For such an arrangement, the deployment period may be a bit longer, usually 2 weeks.

After deployment, customers get onboarding training to help them quickly understand the system. The Superlender team has an efficient support system that ensures all their customers are online throughout.

In addition, they are ready to help players looking to get into the loan lending space.

They offer free consultations on request. Furthermore, they develop customer-facing applications for lenders who are just starting the loan business. This is a separate arrangement from their loan management system.

If you are looking to start a loan lending business in Kenya or a Microfinance institution, this interactive system demo is a good place to start.

Customer Base and Challenges

Changes in rules and regulations especially in digital lending have challenged the loan industry. For instance, in 2021 former President Uhuru Kenyatta signed the CBK Amendment Act, which outlines a ton of stringent regulations for loan apps.

This led to Superlender customers who had difficulties complying scale down their operations.

Nevertheless, Superlender has success stories. The web app is currently serving a number of key financial lending institutions in the country.

A current client using the system with a client base of about 700,000 clients. The system has also helped a client grow their loan book to KSH 2.5 B.

In deed , this is proof of the benefits the system offers its users.

AI and the future.

Mr. Ngarama and the team are always improving Superlender. They learn from existing client base needs and improve the system. Also, they learn from emerging trends and make sure the system is in line with them.

They believe AI will be key in understanding loan clients and interpreting data.

As such, they are working on ways to integrate AI into their system to help minimize data bias when it comes to credit ratings for loan applicants. Superlender is a powerful application occupying a critical market in Kenya today.

Do visit the Superlender website and learn more.