The new service was meant to eliminate the need for customers to visit physical bank branches as all the core banking services would be provided through the app.

I have used Loop since it was launched and here’s my experience with the service:

The Registration Process

Probably the most annoying aspect of the service, the registration process is too long. Once you download the app, you will be required to register for the Loop account which involves filling forms after forms after forms on your device. The information required is also not that necessary but somehow CBA thought that you shouldn’t get an account if you cannot tell them how much you earn monthly, where you work (the address) and even where you live.

To add insult to the injury, you cannot use the app until you have completed registration, which involves you walking into a bank and spending some time to get your biometrics and picture taken and collect your MasterCard-powered CBA Loop Debit Card.

I do understand that the process is important for the KYC (Know Your Customer) purposes but even government services just need my National ID number. Shortening this process should be on CBA’s to-do list as it turns away so many potential customers who are looking to “unbank” themselves but end up in a banking hall anyway.

The APP

The best thing about CBA Loop and the core of the service is the app itself. Admittedly, the app is beautifully designed and well thought out. Once you launch the app, you’re met with a dashboard that shows you an analysis of your income versus your spending and an “Ok to spend” tab that shows you how much money you have to play around with.

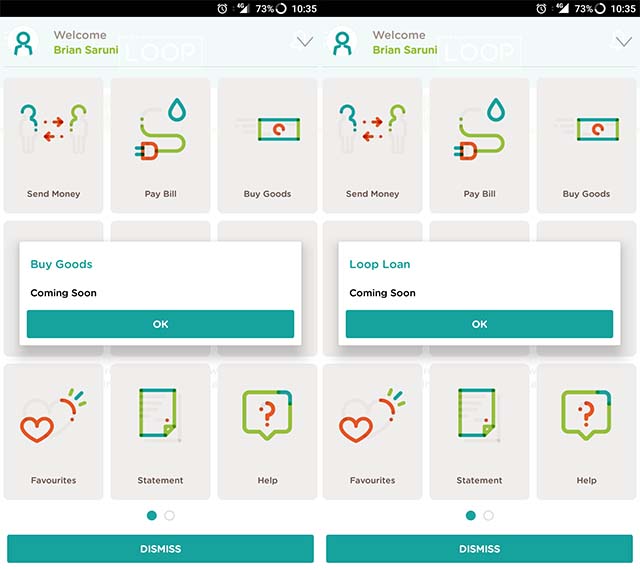

Tapping the hamburger menu on the top-left takes you to a list of well-arranged square menus. Here you’ll find different options such as sending money, paying bills, investing (Loop Invest), loans (Loop Loan), your bank statement, budgeting, loop goals and cash flow statement among others.

Using the app is easy, as there are no hidden tricks or special learnings required. The only downside, is the app would not show me my information on the home screen as required, it would otherwise display an error, which was annoying as it happens more times than it should.

What Works…

Sending Money

Through the Loop app, you can send money using various methods, categorized into mobile or bank transfers.

The mobile category has options such as sending money directly through Loop or through Pesa Link or through Mobile Money. Each category has its own corresponding charge; Loop transfers are charged at Ksh.33, Pesa Link at Ksh.44 and Mobile Money at Ksh.69.3

Sending money directly to a bank account has the following options, Loop transfer, Pesa Link, EFT (Electronic Funds Transfer) and RTGS (Real Time Gross Settlement). With these options, there are corresponding charges with Loop and Pesa Link remaining the same while EFT and RTGS are set at Ksh.60.5.

All these figures are constant regardless of the amount of money you are sending.

Loop Invest

Investing is not an easy task. You must know your financials well and get to know the trends and state of the economy. This for the longest time, together with the assumption that investing is for the rich, has made millenials shy away from investing (this is just an assumption based on the people I interact with).

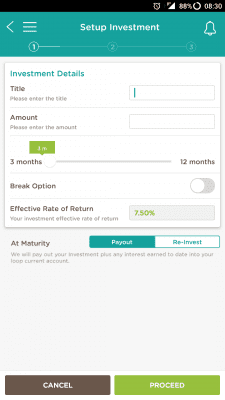

However, Loop App makes it as easy as setting the amount you want to invest, selecting your investment period, which is between 3 months and 1 year and setting whether you want a pay-out or to re-invest at the end of your investment period.

One can invest as low as Ksh.1000 and the rate of return goes as low as 7.5% for the three-month and as high as 9% for the twelve-month investment.

I am not a financial guru, so I will refrain from commenting on the rate of return.

Budgeting

This is a simple area that you can create a budget of how you spend your income. The app will use this budget to alert you when you’re spending too much on an item, as opposed to the amount you had set aside for that item. For example, if I set a budget of Ksh.2000 to spend on meals per month, each time I use my Loop card to pay for meals at restaurants, the app will keep track of this and alert me if I spend more than Ksh.2000 on food.

However, for this section to work effectively, you must use the Loop card for all your payments and seeing that Kenyans are not a big on using cards, good luck with that CBA.

Loop Goals

Another helpful section is the Loop Goals section. This section allows you to set financial goals that you’d like to meet, in other words, it helps you save up for something. For example, you’re saving up for a car, this section allows you to set how much you want to be deducted from your account either weekly, monthly, quarterly or annually and set aside for your car savings.

Pay Bill

A major highlight of the Loop app is the pay bill menu. From here, one can pay for bills ranging from DSTV, GOTV, Startimes, Zuku Fiber, Single Business Permit, Parking, NHIF, KPLC Pre-Paid and Post-paid.

One may simply say that all these services have a paybill number and they could simply just pay via m-pesa but it gets interesting. With the Loop app, you are not required to remember any paybill numbers, you simply select the service you want to pay for, say DSTV, input the account number and amount and tap proceed. The app will show you who that particular account number belongs to, to ensure that you do not send money to someone else’s account.

It works well and makes paying bills that much easier. Plus, paying for your bills through the app ensures that your spending is recorded and you can stick to your budget. The service is powered by Cellulant, the same company behind the Mula payments app.

Hopefully they can add more services within it. JTL? Safaricom FTTH? NSSF? The list is long.

What doesn’t Work…

Certain menus still don’t work on the Loop app, for instance, you cannot get a loan through Loop Loan section, Buy Goods doesn’t work as well and as mentioned earlier, the “Ok to Spend” section works intermittently.

The service also charged customers Ksh.44 transaction fee to buy airtime, which did not sit well with its customers. Instead of removing this transaction fee, CBA did the noble thing and removed the option to buy airtime altogether.

Should you unbank yourself?

Aside from the irony of that tagline, unbank yourself, CBA Loop is a neat product. It has the potential to grow into something that every millennial will be running for but for now, it still needs some work.

The sign-up process is too long, CBA ATMs are hard to find and the app doesn’t even have an option to find the ATMs, we hate cards (not me though) – so give us incentives to encourage us to use the card as opposed to just withdrawing the cash and finally, the app needs to work 100%, 80% is not good enough. We’re millennials, we might easily get distracted by the competition.