Safaricom has several savings and lending products, some of which are co-owned with other lenders in the country.

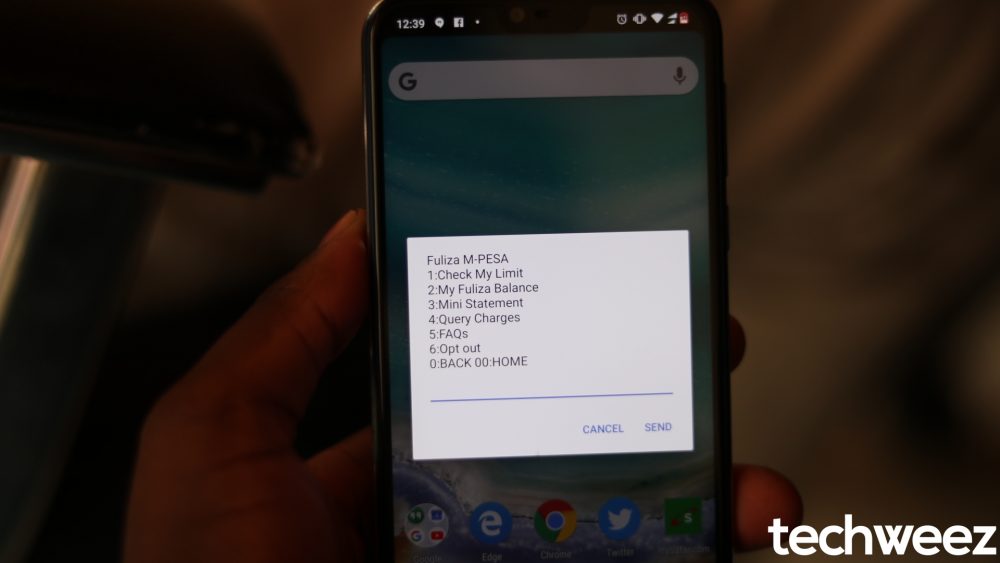

More than one year ago, the carrier launched Fuliza, an overdraft facility that has proved its popularity based on ease of use. Safaricom, to date, does not call it a loan product, but its features have all the markings of lending product.

Earlier today, the carrier announced its Full Year results for 2021.

We gave looked at the numbers in the savings and loan segment, which reveals that the company made a killing from Fuliza, more than KCB M-PESA and M-Shwari.

All products recorded notable growth over the year, bearing in mind the country was under lockdown and thousands of people lost their source of income.

So, how did Fuliza perform?

Here is the Fuliza breakdown:

Safaricom disbursed KES 351.2 billion for the FY21 period, which is 43.6 percent higher than the value it disbursed in 2020.

The value of repayment for the year under review stood at KES 345.7 billion.

The rate of repayment versus disbursal stood at 98.4 percent. This is a good number because it means that very few have defaulted repaying their overdrafts.

The product also has 1.4 million daily active users, which double what it recorded in 2020.

The average Fulliza size to customers was at KES 446.2.

On the whole, Fuliza made the carrier KES 4.5 billion in the year, more than KCB M-PESA and M-Shwari.

KCB M-PESA

Value of disbursement – KES 51.1 billion

Value of loan repayments – KES 51.3 billion

Rate of repayment versus disbursal – 100.3%

Average loan size – KES 8724.4

Monthly active users – 3.3 million

Revenue – KES 800 million

M-Shwari

Value of loan disbursement – KES 94.5 billion

Value of loan repayments – KES 53.9 billion

% repayment versus disbursal – 57.1%

Average loan size – KES 5575

Monthly active users – 4 million

Revenue – KES 2.2 billion