Pesalink has announced that it will soon have a merchant payment option to rival Safaricom’s Lipa na M-pesa. The news comes after Safaricom’s customers expressed concerns due to over reliance on the Mpesa feature which has been suffering periodic outages in the last 24 hours.

Currently, the company states that “most Pesalink Payments are business-related: bulk transactions, invoices, rent and more”.

However, they they have promised that a merchants payment feature is “coming soon“. The company has not offered any timeline for the roll out.

How will it work? At the point of sale, a buyer will not need to transfer funds from a bank account to a mobile money account. Buyers will be able to pay sellers straight from their bank accounts.

Pesalink is owned by the Kenyan banking industry’s umbrella body, Kenya Bankers Association. It was unveiled in 2017 as a real-time interbank switch. The system is specifically meant to help customers to send money to one another and to bank accounts without the need for intermediaries.

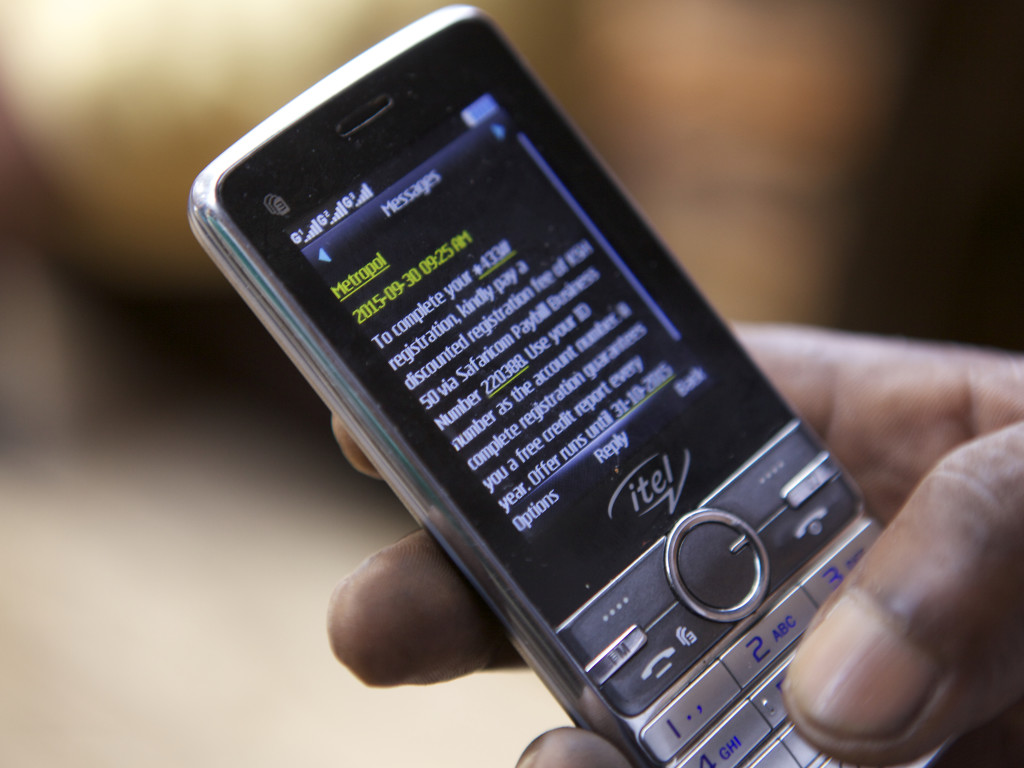

It is designed to be a mobile first platform accessible via bank mobile app, internet banking or USSD. Users can send from Ksh 10 to 999,999 to take advantage of instant bank to bank payments. Like most digital platforms, Pesalink is available 24/7.

It was launched with 12 banks as part of the platform. It has since grown and consists of 31 banks in the country. It is also used by many payment service providers, SACCOs, and telecommunication companies.

Pesalink Low Market Penetration

Despite being a cheaper digital transfer service, the uptake has not been so high. This could be due the higher number of mobile money account holders compared to bank account holders.

Data from the Communication Authority of Kenya (CA) shows the country has 38,432,728 active mobile Money subscriptions. This means Kenya has a penetration level of 75.1 per cent. On the other hand, according to data from the Kenya National Bureau of Statistics. 69 % of Kenyan adults don’t have a commercial bank account.