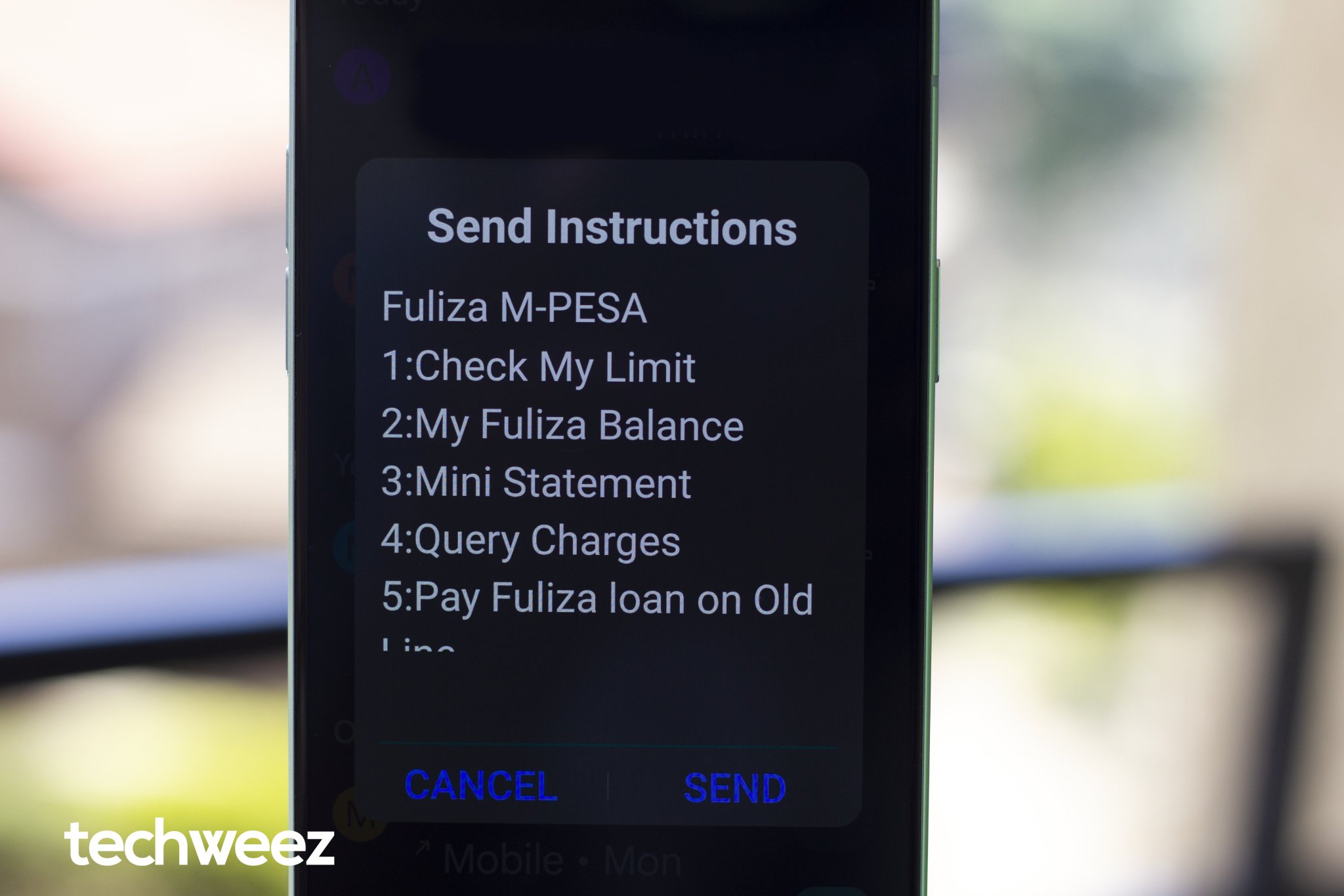

Safaricom now allows customers to withdraw cash from its overdraft facility, Fuliza. This feature has been available for a couple of weeks, but the telco has not officially announced it. When the product launched in 2019, it was limited in terms of its use cases. At that time, users could only:

- Send cash to friends and family

- Use Lipa na M-PESA services such as Paybill and Buy Goods

- Buy airtime for themselves and others via USSD or the M-PESA app (it does not work on the mySafaricom app)

This new addition is key because it now makes Fuliza more functional and allows customers to avoid having to:

- Get another SIM card that does not have an overdraft to transact

- Send money to another person who does not have Fuliza so they can withdraw it for them

- Tell a sender not to send money to them because they have an overdraft

To some extent, this is all Safaricom needed to do; give customers an official way to access the funds for other uses other than paying bills or sending cash to friends and family.

Does this make it a loan product now? Likely so, although the telco continues to insist that Fuliza is not one (KCB M-M-PESA and M-Shwari are).

Fuliza is also one of Safaricom’s biggest earners. It has overtaken the likes of KCB M-PESA and M-Shwari in terms of earnings. For instance, by March 2022, it had KES 502.66 billion in value of Fuliza disbursements, a 43.1% YoY increase with 101.5% repayment versus disbursal rate. The telco reached KES 5.94 billion in Fuliza revenue, a 31.0% YoY increase.

Lastly, Fuliza rates have since been adjusted downwards, meaning customers now pay less than the initial rates.

| FULIZA TARIFF | |||

| Band | Tariff | 20% Excise Duty | Total Charges |

| 0 -100 | KSh 0 | KSh 0 | KSh 0 |

| 101-500 | KSh 2.5 | KSh 0.5 | KSh 3 |

| 501-1000 | KSh 5 | KSh 1 | KSh 6 |

| 1001-1500 | KSh 18 | KSh 3.6 | KSh 21.6 |

| 1501-2500 | KSh 20 | KSh 4 | KSh 24 |

| 2501-70000 | KSh 25 | KSh 5 | KSh 30 |