A couple of months ago, Telkom Kenya axed Orange Money services. The development was in line with the telco’s plan to transition from Orange to Telkom, a process that was marked by multiple changes that included administration swaps and infrastructural improvements.

A couple of months ago, Telkom Kenya axed Orange Money services. The development was in line with the telco’s plan to transition from Orange to Telkom, a process that was marked by multiple changes that included administration swaps and infrastructural improvements.

The cancellation of Orange Money paved the way for the development of a replacement that customers have waiting for some time. While a quick launch of an improved mobile money service was thought to replace the terminated product in a timely manner, the telco had to seek approval from the Central Bank of Kenya, and the exercise, which was mentioned in January, pushed the launch to today.

Dubbed T-kash, Telkom’s M-PESA and Airtel Money competitor has finally seen the light of day. Launched earlier today, the product is geared towards meeting multiple strategic goals for the carrier. The launch was graced by ICT Cabinet Secretary Joe Mucheru, Telkom CEO Aldo Mareuse, among other notable figures.

“The entry into Mobile Financial Services for Telkom is, therefore, a strategic move to better utilize our infrastructure, providing customer value for current services while aligning to future market developments. Because we are fully aware that to achieve financial inclusion in the years ahead is not just about applying and building on existing products but continued innovation to better meet the needs of the excluded,” remarked Mr. Aldo.

Before we dive into the specifics of T-kash, it is worth noting that the carrier started developing the product more than two years ago. As highlighted by Anuj Tanna, the Director of Mobile Financial Services, Telkom had to factor in some variables to accommodate the personalities of all Kenyans, a process that called for a bottom-up approach in building T-kash. Among the activities that were performed to meet the said purpose include extensive recruitment and on-boarding of agent network and the inclusion of innovative features that are unique to the mobile money service.

T-kash Offerings

Value

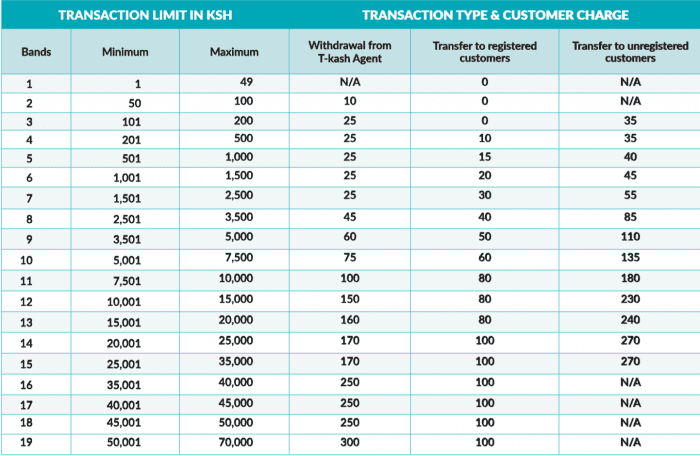

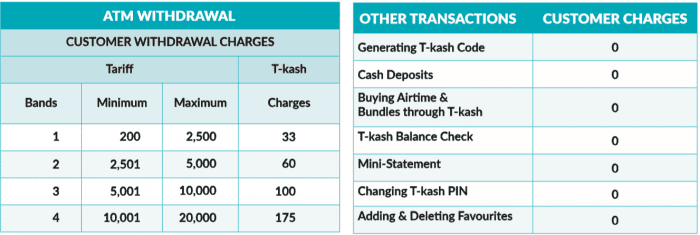

It is a known secret that mobile money users have always felt short-changed based on fees charged for transactions. Telkom Kenya promised to eliminate these concerns via competitive pricing as well as transparency and visibility regarding transactional charges. While this is a notable step for T-kash, competitors such as Safaricom’s M-PESA and Equitel have since adopted the same approach in ensuring users don’t have to hunt for charts that display fees associated with the product.

Quick reversals

Thousands of mobile money users have lost millions of shillings by sending cash to wrong persons. It is a menace that has been a headache for competitors up to a couple of months ago where some of them introduced a feature that displays the name of a recipient before confirming a transaction.

Telkom is implementing the same feature for T-kash to eliminate transactional errors.

T-kash Code

Perhaps the most prominent innovation or feature for the product, T-kash code aims to shorten the process of making withdrawals or making payments.

Current alternatives dictate punching in of agent and till numbers, which Telkom feels is tedious and cumbersome. In contrast, T-kash code drops till numbers as a way to transact for a unique, 8-digit one-time code that will be generated by customers. The code is then presented to an agent (for withdrawal) or merchants (for tills). The telco promises speed and security. Also, customers will not need to perform reversals because there is no channel to input the wrong till or agent number.

It should be remembered that as long as subscribers have money in their T-kash accounts, they can generate codes until their cash reservoir reaches zero. Also, any T-kash users can generate a T-kash code for someone else to withdraw money or buy goods services – an interesting feature that we’ll explore and report in coming days.

T-kash Favourites

To offer a platform that is quick and convenient, T-kash is equipped with ‘smart’ features that ensure a customer’s frequently used bill and numbers are saved for quick access while performing transactions. What’s more, the same personalized experience will be available on USSD and STK.

Bonuses

Customers will score 25 percent bonus airtime if purchased via T-kash. The same channel of airtime purchase will offer customers double entries for the ongoing FormNi50 promotion where lucky subscribers walk away with a new Toyota Belta, every day.

At the same time, Telkom subscribers can buy data bundles directly from the mobile money product.

Distribution

To push a wide adoption of T-kash, Telkom has netted more than 20,000 agents that will avail the product’s service offerings to near 4-million active subscribers that the telco has managed to amass. Of course, the number will continue to grow if more people embrace T-kash.

Notably, the maximum account T-kash balance is KES 100,000. Similar to M-PESA, the maximum daily transaction value is KES 140,000. Users are only allowed KES 70,000 per transaction.

Issues arising from the product can be sorted via T-kash customer care by dialing 160 for free.

Finally, T-kash is available both on the STK menu, USSD (*160#) and on T-kash app on both Android and iOS. The last channel is puzzling owing to the existence of My Telkom app. A universal utility app with bundled T-kash services would have been awesome, but maybe that will change in the coming days.