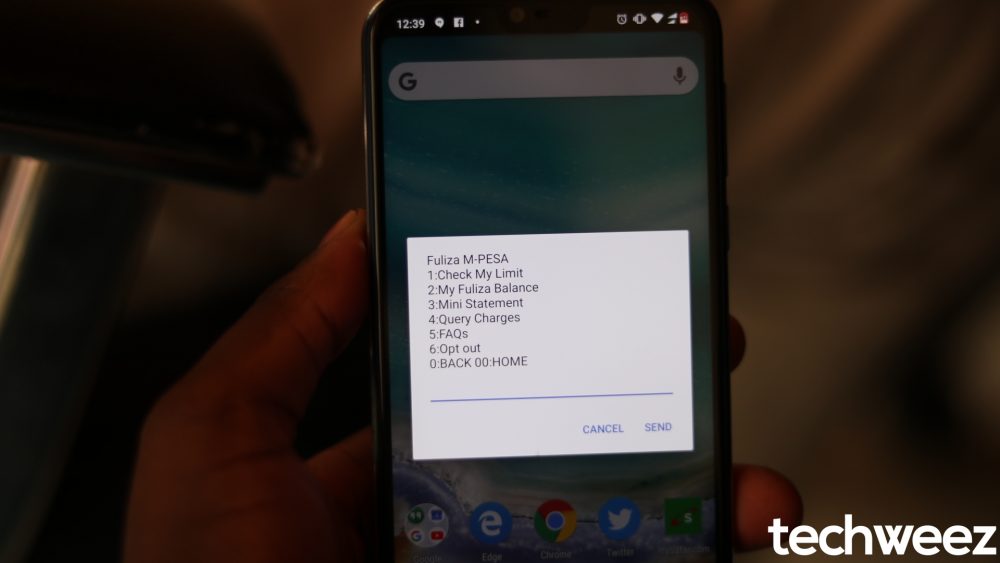

Fuliza has been around for nearly three years now.

The overdraft facility helps Safaricom M-PESA customers complete payments or send cash to another person if they do not have sufficient funds in their M-PESA wallets.

Since its launch, Fuliza charged customers a standard rate based on the amount overdrawn.

However, this is going to change as of November 14, 2021, in updated terms and conditions that will surely see that customers do not default to the facility.

Now, customers will be paying a daily administrative fee and a one-off 1.083% interest.

Also, Fuliza, which is owned by Safaricom, KCB and NCBA, will stop access to KCB M-PESA savings and Mshwari (run by NCBA too) if a customer defaults their Fuliza overdraft.

Here is a section from the updated terms and conditions regarding what constitutes a default:

An event of default occurs:

- Where any Facility is due and unpaid for (30) thirty days or more, or

- Where you have exceeded your Overdraw Limit; or

- If any representations or statements or particulars made by you are found to be incorrect; or

- If you commit any breach or fail to observe, keep or perform any of the terms, conditions covenants or provisions of any other agreement between us and yourself in respect of the Facility; or

- If there is reasonable apprehension that you are unable to pay your debts or we receive any notice that you have admitted any inability to pay your debts as they become due; or

- If you are convicted under any criminal law in force related to use of the services or any other related services; or

- If any judgment or decree in any legal proceedings is passed against you which is not satisfied within seven (7) days of demand, or

- If a Garnishee or Attachment Order or a lien created against any of your deposits with us or assets maintained by you is made.

Now as said, in case of a default, then the facility will hold your funds standing in credit with KCB (KCB M-PESA) or NCBA (M-Shwari) as collateral and security for outstanding Fuliza amounts.

Here is the wording from the T&C:

- At any time after an Event of Default has occurred which is continuing, KCB and NCBA may, without prejudice to any other right or remedy granted to us under any law:

- hold any of your funds standing in credit with KCB or NCBA as collateral and security for any amounts outstanding and due from you in respect of the Facility or Service. You hereby agree and confirm that NCBA and KCB is entitled in its discretion to prevent or restrict you from withdrawing in whole or in part the funds in your accounts for so long as and to the extent of the amount outstanding in respect of your Loan without KCB or NCBA giving any notice to you and/or without incurring any liability to you whatsoever in that connection.

- have a right of lien and set off over funds held by you in any of your accounts with KCB or NCBA. KCB or NCBA may, without notice, set off against any amount due from any other account whether current, loan, or loans or any other type of account. A right of lien and setoff shall exist over savings and mobile saving accounts

To note, Fuliza is already big, bigger than KCB M-PESA and M-SHWARI in terms of revenue generated.

Specifically, Safaricom disbursed KES 351.2 billion in Fuliza for the FY21 period, which is 43.6 percent higher than the value it disbursed in 2020.

KCB M-PESA’s value of disbursement was at KES 51.1 billion.

M-Shwari value of loan disbursement was at KES 94.5 billion.

TLDR: Starting November 14, Fuliza customers will be paying a daily administrative fee and a one-off 1.083% interest.

If you default your Fuliza facility (fail to pay after 30 days, among other definitions of a default), Safaricom, KCB, and NCBA can hold funds on your M-Shwari and KCB M-PESA accounts as collateral – and even use the same to clear your overdraft.

We understand where this is coming from because Fuliza is not a loan facility, and is therefore regularized as soon as you receive funds in your M-PESA wallet. The action itself has forced people to use other mobile money platforms, or have secured new SIM cards to avoid paying for overdraft bills. The other option has been paying up the facility, and then overdraw to paybill services, effectively making customers a slave of Fuliza.